BTC Price Prediction: 2025-2040 Outlook Amid Market Divergence

#BTC

- Technical Outlook: Short-term bearish pressure below 20-day MA, but MACD signals long-term bullish momentum.

- Market Sentiment: Institutional growth (Bakkt, Babylon) offsets ETF outflows and skeptic rhetoric.

- Price Trajectory: 2025–2040 targets reflect accelerating adoption, with $1M+ scenarios post-2035.

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish Pressure Amid Long-Term Bullish Signals

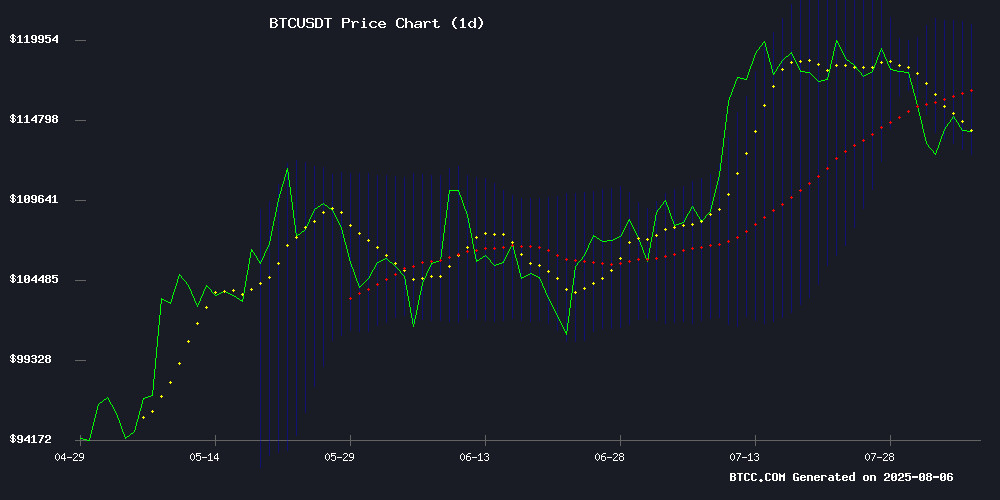

According to BTCC financial analyst Emma, Bitcoin (BTC) is currently trading at $115,219.19, slightly below its 20-day moving average (MA) of $116,824.30, indicating short-term bearish pressure. However, the MACD (12,26,9) shows a bullish crossover with the histogram at 1,621.8747, suggesting potential upward momentum. Bollinger Bands reveal BTC is trading near the middle band, with support at $112,759.40 and resistance at $120,889.21. Emma notes that while the current dip may test investor patience, the broader technical setup remains favorable for accumulation.

Mixed Market Sentiment as Institutional Adoption Grows Amid Volatility

BTCC analyst Emma highlights conflicting market signals from recent news. Positive developments like Bakkt's $235M Japan deal and Babylon's trustless bitcoin vaults for DeFi underscore growing institutional interest. However, outflows from Bitcoin ETFs ($330M) and Peter Brandt's criticism reflect short-term skepticism. Emma emphasizes that such volatility is typical during adoption phases, and the long-term trajectory remains bullish given sustained accumulation trends and expanding utility (e.g., CryptoAppsy's tracking platform, INEMiner's cloud mining).

Factors Influencing BTC’s Price

CryptoAppsy Launches Real-Time Market Tracking Platform for Cryptocurrency Traders

CryptoAppsy emerges as a nimble mobile solution for cryptocurrency traders seeking real-time market intelligence. The platform delivers instantaneous price updates across thousands of digital assets, from Bitcoin to emerging altcoins, with latency measured in milliseconds. Its infrastructure aggregates data from global exchanges, enabling traders to spot arbitrage opportunities and react to volatility.

The application distinguishes itself through zero-account registration requirements and cross-platform availability. Traders can monitor personalized watchlists, track portfolio performance, and set price alerts without cumbersome onboarding processes. Historical charting tools provide technical context for market movements.

Editorially curated news supplements the quantitative features, offering qualitative insights from industry experts. The combination aims to give retail traders institutional-grade tools in a consumer-friendly package.

Babylon Launches Trustless Bitcoin Vaults to Expand DeFi Utility for BTC

Babylon has unveiled trustless vaults for its Bitcoin staking protocol, marking a significant step toward decentralized finance (DeFi) integration for BTC. The innovation allows users to deposit Bitcoin without relying on centralized intermediaries, leveraging smart contracts for security and operational rules.

The vaults enable BTC to function as collateral in DeFi applications, including lending, stablecoin issuance, and staking. Participants can earn yield in Babylon's native token, BABY, by staking Bitcoin to support proof-of-stake networks. This development taps into Bitcoin's $5 billion staking protocol, aiming to unlock the asset's dormant value for cross-chain DeFi activity.

Bitcoin's dominance—accounting for over 60% of the total cryptocurrency market cap—positions it as a potent fuel source for blockchain ecosystems. Babylon's move reflects a broader industry trend to bridge Bitcoin's liquidity with DeFi innovations across competing networks.

INEMiner Launches Cloud-Based Bitcoin Mining App

INEMiner has introduced a mobile application that allows users to mine Bitcoin through cloud computing, eliminating the need for expensive hardware. The app promises ease of use, accessibility, and transparent operations, catering to both novice and experienced miners.

Users can start mining with minimal setup, monitor their earnings in real-time, and withdraw Bitcoin to any wallet. The platform emphasizes security and a user-friendly interface, aiming to democratize Bitcoin mining.

Peter Brandt Slams Bitcoiners as ‘Idiots’ While Saylor Defends Crypto

Veteran commodity trader Peter Brandt has ignited a firestorm in the cryptocurrency community with his scathing critique of Bitcoin enthusiasts. Brandt derided holders as "idiots" and lambasted the "hodl" mentality, calling leveraged Bitcoin purchases "unsound financial practice." His assertion that Bitcoin is "just an asset" rather than a belief system drew sharp rebukes across social media platforms.

Michael Saylor emerged as the ideological counterweight, framing Bitcoin as a protocol-governed asset with inherent philosophical value. The MicroStrategy executive positioned Bitcoin's growing adoption as directly tied to its foundational principles—a stark contrast to Brandt's utilitarian perspective. This clash underscores the ongoing tension between Bitcoin's financial and ideological dimensions.

Bakkt Acquires 30% Stake in Japan’s MarushoHotta, Plans Bitcoin Pivot

Bakkt Holdings Inc., a prominent crypto infrastructure provider, has secured a 30% stake in Tokyo-listed kimono manufacturer MarushoHotta Co. for CNY 1.68 billion ($235.2 million). The acquisition positions Bakkt as the largest shareholder and marks a strategic shift toward Bitcoin adoption.

The deal follows Bakkt's recent $75 million public offering, with proceeds earmarked for Bitcoin purchases and corporate expansion. Post-acquisition, MarushoHotta will rebrand as bitcoin.jp—a move underscored by Bakkt's acquisition of the domain www.bitcoin.jp. Phillip Lord, President of Bakkt International, will assume CEO duties.

This pivot reflects growing institutional interest in cryptocurrency treasury models, with Bakkt leveraging its Japanese foothold to accelerate Bitcoin integration in traditional markets.

Bakkt's Strategic $235M Japan Deal Spurs Stock Rally and Crypto Expansion

Bakkt Holdings, Inc. (NYSE: BKKT) surged 2.31% to $9.75 intraday after announcing a transformative $235.2 million acquisition of 30% stake in Tokyo-listed MarushoHotta Co. The deal includes rebranding the Japanese firm to bitcoin.jp, signaling a full pivot to digital assets under new leadership. Japan's crypto-friendly regulations catalyzed the move, positioning Bakkt to capitalize on Asia's Bitcoin treasury adoption wave.

The rebranding and structural overhaul of MarushoHotta's treasury operations reflect institutional confidence in regulated crypto markets. Trading activity spiked as investors recognized Bakkt's first-mover advantage in bridging traditional finance with Japan's booming digital asset ecosystem. The strategic play mirrors growing institutional demand for Bitcoin exposure through compliant channels.

Robert Kiyosaki Praises Bitcoin as the 'Easiest Millions' He’s Ever Made

Renowned author and financial educator Robert Kiyosaki has doubled down on his bullish stance toward Bitcoin, calling it the most effortless wealth-building tool he’s encountered. In a recent post, the 'Rich Dad Poor Dad' author contrasted Bitcoin’s passive growth potential with the grueling demands of traditional investments like real estate.

"Bitcoin is pure genius," Kiyosaki wrote. "No mess, no stress. Just set it and forget it." He reflected on how a modest initial investment ballooned into millions with minimal active management—a stark contrast to his early career in real estate, which required "hard work, lots of risk, and many sleepless nights."

Kiyosaki credited Bitcoin’s anonymous creator, Satoshi Nakamoto, for designing a system that rewards patience. His remarks come as stablecoin transaction volume surpasses $1.5 trillion in a single month, underscoring growing crypto adoption.

Bitcoin ETF Outflows Reach $330M as Investors Seek Alternatives in Cloud Mining

Bitcoin spot ETFs are facing significant capital outflows amid heightened market volatility, with $330 million withdrawn in a single day. BlackRock's IBIT product alone accounted for $292 million of the outflow, marking one of the largest single-day redemptions since 2025. This trend underscores the fragility of traditional ETF structures in the current crypto climate.

Investors are increasingly turning to passive income solutions like cloud mining to navigate market uncertainty. Find Mining, a global cloud mining platform, has launched a new mobile app offering automated mining services. The company leverages AI-driven resource management and operates 135 eco-friendly data centers across 175 countries, eliminating the need for hardware or technical expertise.

Bitcoin Realized Prices Show Sustained Accumulation Trend

Bitcoin's on-chain metrics reveal robust accumulation patterns as all three realized price benchmarks trend upward. Short-Term Holder Realized Price now sits at $106,000—a critical support level in bull markets—while Long-Term Holders' cost basis holds firm at $36,500. The aggregate realized price stands at $51,348, according to Glassnode's latest data.

Market volatility saw BTC briefly test $111,000 before recovering to $114,000. The consistent elevation of realized prices across cohorts signals deepening investor conviction. Older coins (155+ days inactive) continue demonstrating diamond-hand behavior, while newer acquisitions reflect confidence at elevated price levels.

Realized price methodology provides unique insight by calculating the average on-chain acquisition value. This metric's segmentation reveals strategic differences between transient traders and committed holders—a dichotomy becoming increasingly pronounced as Bitcoin's market structure matures.

Bitcoin Dips Amid Market Turmoil: Can Altcoins Stage a Comeback?

Bitcoin's price volatility has intensified, with a recent dip to $112,650 before rebounding to $114,000. Market turbulence stems from geopolitical tensions, U.S. economic data, and new tariffs. Analysts eye the $112,000 level as a critical support threshold—breaching it could trigger deeper losses.

Altcoins face mounting pressure as Bitcoin dominance wavers. Michael Poppe notes the significance of Bitcoin holding higher lows: "A test of $115,000 resistance could signal altcoin momentum." TRUMP's pending Apple-related announcement adds another layer of uncertainty to today's session.

Bitcoin Supporter Marsha Blackburn Runs for Tennessee Governor

Senator Marsha Blackburn, a prominent advocate for Bitcoin, has declared her candidacy for Tennessee governor in the 2026 election. Her campaign underscores a pro-crypto agenda, including support for a national initiative to acquire 1 million BTC. Blackburn aligns with conservative principles and former President Trump, positioning Tennessee as a future hub for conservative policies.

The senator's platform emphasizes job creation, energy independence, education reform, and law enforcement—a strategy designed to resonate with her base. Her vocal backing of digital assets could signal broader political acceptance of cryptocurrency in state governance.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Price Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $90,000–$150,000 | ETF flows, halving aftermath, institutional adoption |

| 2030 | $250,000–$500,000 | Scalability solutions, regulatory clarity, DeFi integration |

| 2035 | $700,000–$1.2M | Global reserve asset status, hyperbitcoinization |

| 2040 | $1.5M–$3M+ | Network effect dominance, store-of-value consensus |

Emma projects Bitcoin's price will recover from 2025's volatility to enter a multi-year bull cycle, driven by institutional adoption (e.g., Bakkt's expansion) and technological upgrades. By 2030, BTC could rival gold's market cap, with post-2035 targets assuming it becomes a global monetary standard. Risks include regulatory shifts and competition from altcoins during interim corrections.